Introduction

Decision making is a part of our every day, we make countless decisions—some small and routine, others significant and life-changing. Understanding how we make these decisions and how to improve them is crucial for both personal and professional success.

Daniel Kahneman, a Nobel Prize-winning psychologist, provides a powerful framework for decision-making in his book Thinking, Fast and Slow.

His model describes two systems of thinking- System 1, which is fast and intuitive, and System 2, which is slow and deliberate. By understanding these systems and learning how to manage them effectively, we can make better decisions and reduce errors caused by cognitive biases.

Two Systems of Thinking

There are two important systems of thinking, these include-

System 1: Fast, Intuitive, and Automatic

System 1 operates quickly, with little or no effort. It is responsible for instinctive and automatic reactions, such as recognizing a familiar face in a crowd, finishing common phrases, or dodging an oncoming car. This system is essential for our survival, as it allows us to react rapidly to danger and make snap judgments when necessary.

Characteristics of System 1-

- Speed- Operates instantly, without conscious effort.

- Efficiency- Handles routine decisions effortlessly.

- Emotionally Driven- Influenced by feelings and intuition.

- Prone to Bias- Can lead to errors, especially when facing complex or unfamiliar situations.

Some examples of type 1 thinking include-

- Instantly recognizing someone’s mood based on facial expressions.

- Making a quick decision about whether a stranger seems trustworthy.

- Reflexively slamming the brakes when a car suddenly stops in front of you.

While System 1 is useful, it can sometimes lead to mistakes because it relies on heuristics (mental shortcuts) that may not always be accurate.

Read More- Breaking Bad Habits

System 2: Slow, Analytical, and Effortful

System 2, on the other hand, is deliberate, logical, and requires effort. It is engaged when we solve complex problems, analyze data, or make important financial and career decisions. Unlike System 1, it demands concentration and cognitive resources, making it more reliable for making rational choices.

Characteristics of System 2-

- Slower Processing- Requires time and effort to function.

- Logical and Analytical- More systematic and data-driven.

- Energy-Intensive- Easily fatigued and requires focus.

- More Accurate- Less prone to biases when used correctly.

Some examples of type 2 thinking include-

- Comparing mortgage rates to decide on a home loan.

- Writing a detailed business plan.

- Learning a new language or skill that requires concentration.

Although System 2 is more reliable, it is not always engaged. Often, we rely on System 1 by default, especially when under stress, time constraints, or cognitive overload.

Common Cognitive Biases

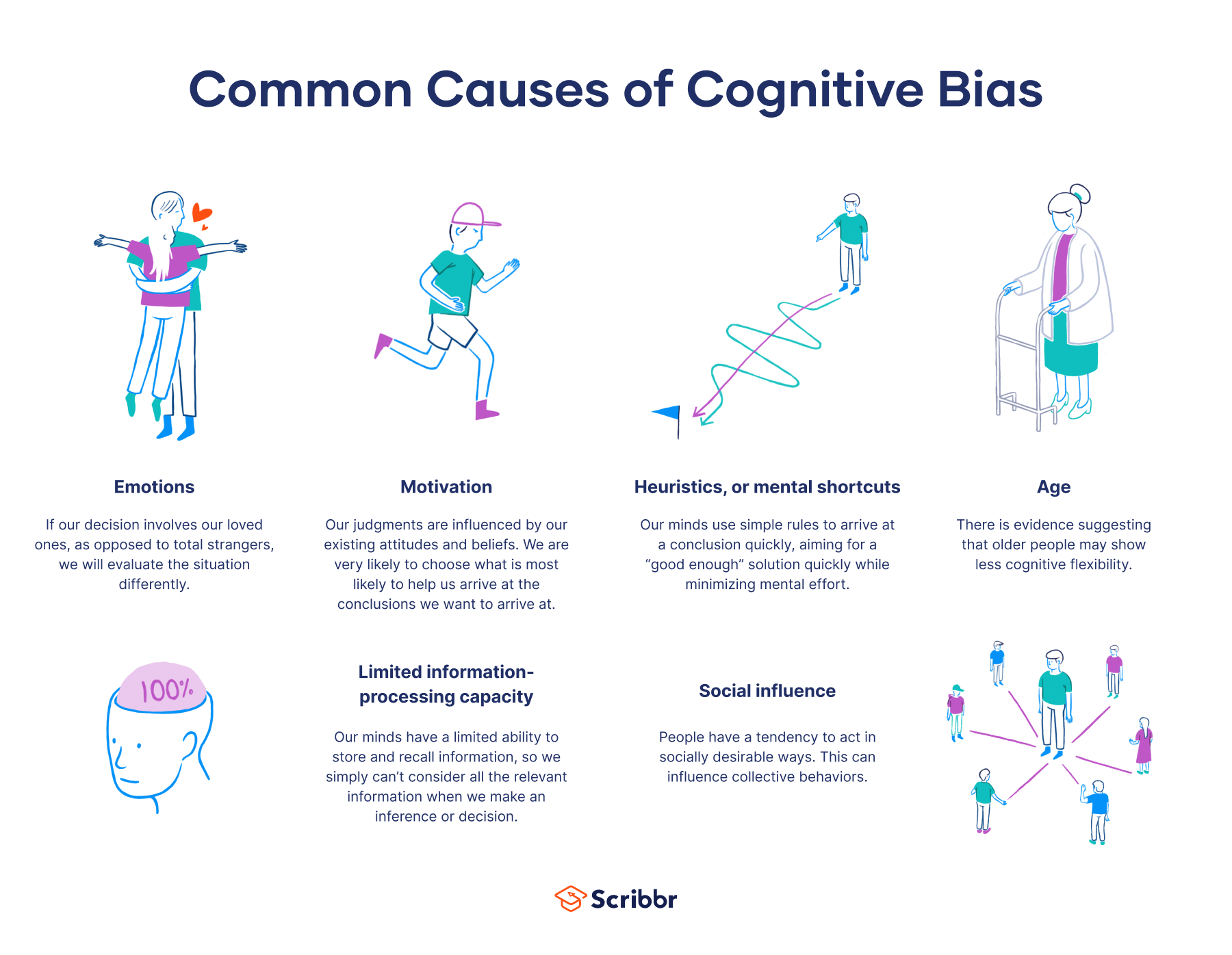

Kahneman and his research partner Amos Tversky identified several cognitive biases—systematic errors in thinking that influence our decisions. These biases stem from our reliance on System 1 and can lead to poor judgment. Here are some of the most common biases and how they affect decision-making-

- Anchoring Bias- This occurs when we rely too heavily on the first piece of information we receive (the “anchor”) when making decisions. For example- A car salesman initially offers a high price, making a subsequent lower price seem like a great deal, even if it’s still overpriced.

- Confirmation Bias- The tendency to seek out, interpret, and remember information that confirms our existing beliefs while ignoring contradictory evidence. For example- A person who believes in a particular political ideology may only consume news that supports their viewpoint and dismiss opposing perspectives.

- Overconfidence Bias- The belief that our judgments and abilities are more accurate than they actually are. For example– Investors who overestimate their knowledge may take excessive risks in the stock market.

- Availability Heuristic- The tendency to judge the likelihood of an event based on how easily examples come to mind. For example- After hearing about a plane crash, people might overestimate the dangers of flying, even though statistics show air travel is much safer than driving.

- Loss Aversion- People tend to prefer avoiding losses rather than acquiring equivalent gains. For example- Investors might hold onto a losing stock for too long to avoid admitting a loss, even when selling would be the better option.

Understanding these biases is crucial because they can unconsciously shape our decisions and lead to mistakes.

Strategies for Better Decision-Making

Improving decision-making requires awareness of how our minds work and adopting strategies to counteract biases. Below are effective techniques based on Kahneman’s research.

1. Engage System 2 When Necessary

- Take a step back before making important decisions and consciously engage your slow, analytical thinking.

- Example: Instead of making an impulse purchase, take time to compare options, read reviews, and consider long-term value.

2. Question Initial Impressions and Gut Feelings

- Since System 1 can be prone to errors, challenge your first reaction, especially in critical situations.

- Example: Before hiring someone based on a “good feeling,” assess their qualifications systematically.

3. Use Decision-Making Frameworks

- Structured approaches, like pros and cons lists, cost-benefit analysis, and decision trees, can help improve choices.

- Example: A business owner deciding on a new investment can use a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to weigh options more effectively.

4. Seek Diverse Perspectives

- Avoid confirmation bias by gathering input from different sources and considering alternative viewpoints.

- Example: Before launching a new product, conduct market research and get feedback from potential customers.

5. Reduce Decision Fatigue

- Making too many decisions in a short time can deplete mental resources, leading to poor choices.

- Example: Simplify daily routines, like meal planning in advance, to conserve mental energy for more significant decisions.

6. Use Probabilistic Thinking

- Rather than making absolute judgments, think in terms of probabilities.

- Example: Instead of assuming an investment will succeed, estimate the likelihood of various outcomes based on historical data.

7. Set Predefined Rules for Decision-Making

- Establishing criteria beforehand can prevent emotional decision-making.

- Example: An investor might set a rule to sell a stock if it drops below a certain percentage to avoid loss aversion.

Conclusion

Making good decisions is both an art and a science. By understanding Kahneman’s model of System 1 and System 2 thinking, we can become more aware of how we make choices and take steps to improve them. Recognizing cognitive biases, slowing down to engage System 2, and using structured decision-making techniques can help us avoid common pitfalls. Whether in finance, business, healthcare, or daily life, applying these insights can lead to better outcomes, fewer regrets, and greater success.

References

Kahneman, D. (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux.

Tversky, A., & Kahneman, D. (1974). “Judgment under Uncertainty: Heuristics and Biases.” Science, 185(4157), 1124–1131.

Heath, C., & Heath, D. (2013). Decisive: How to Make Better Choices in Life and Work. Crown Business.

Subscribe to PsychUniverse

Get the latest updates and insights.

Join 3,045 other subscribers!

Niwlikar, B. A. (2025, January 16). 7 Easy Strategies for Decision Making. PsychUniverse. https://psychuniverse.com/decision-making/

Pingback: How to Recognize Burnout and 7 Important Ways to Deal With It - PsychUniverse

Pingback: Nepotism Decoded: 5 Psychosocial Reasons Behind Kinship Favor - PsychUniverse